[Student IDEAS] by Varun Jain - Master in Management at ESSEC Business School

This article examines why banks have yet to fully adopt blockchain despite its transformative potential. It identifies key barriers - regulatory uncertainty, legacy infrastructure, and operational challenges like interoperability and network effects. Through case studies and analysis, it explores how banks might overcome these issues via regulatory sandboxes, hybrid blockchain models, and internal use cases. Ultimately, the path forward depends on global regulatory alignment, modernization of systems, and industry-wide collaboration.

---

Banking is a fundamental pillar of our economy that aids in activities such as lending, trading, and payment processing. This industry, however, has a long history of relying on established traditional systems and processes, often taking a measured approach when it comes to new technology. Enter Blockchain: a transformative force poised to redefine the finance industry.

Blockchain, the groundbreaking technology behind cryptocurrencies and DeFi (Decentralised Finance) products, is igniting a revolution in the finance industry. Its decentralised, transparent, and secure nature promises streamlined, efficient transactions, potentially cutting through the complex layers of traditional banking procedures.

Yet, as blockchain and blockchain-powered services keep on captivating, the banking sector seems to linger at the edges of this technological revolution. Despite the initial excitement, widespread adoption has been slower than anticipated. Why aren’t these financial powerhouses diving in headfirst? Is it a matter of regulatory concerns, technological incapacity, outdated infrastructure, or something else entirely? Do potential solutions and strategies exist that can help banks overcome these challenges? Or are the problems so fundamental that the promise of blockchain in banking is ultimately unattainable? In this article, we explore the barriers holding banks back from fully embracing the blockchain revolution and chart potential pathways toward widespread blockchain adoption in the financial sector.

Banks are, at their core, the institutional risk managers of the modern economy. They do far more than simply hold deposits or extend credit; banks facilitate payments, allocate capital, and underpin the trust that enables commerce at scale. By verifying identities, assessing credit worthiness, enforcing contracts, and ensuring regulatory compliance, banks create the trust necessary for economic activity to flourish at scale. This intermediation is what allows capital to flow efficiently, payments to settle reliably, and businesses to transact across borders and legal systems.

Yet, the very mechanisms that have made banks indispensable - layers of documentation, compliance checks, and manual reconciliation - comes with significant operational complexity. Traditional banking processes - especially in areas like trade finance, cross-border payments, and compliance - are often slow and burdened by extensive paperwork and multiple layers of verification. These legacy systems, designed to minimize risk and satisfy regulatory requirements, can result in lengthy settlement times, increased costs, and a higher likelihood of errors or delays. The very mechanisms that have made banks reliable intermediaries can also make them less agile in a rapidly digitizing world.

Blockchains are digital ledgers where transactions are stored securely and transparently. Each "block" of information is linked to the previous one, making a "chain" that is extremely hard to tamper with. In easier words, it is like a notebook that everybody can read and write in, but once anything is written, it cannot be removed or changed.

Three salient features define blockchains. A blockchain is decentralized. Instead of being managed by a central authority like a bank or a government, it is maintained by a network of computers. It is transparent, as all transactions on blockchain networks are visible to everyone. Finally, it is immutable because any transaction cannot be changed once recorded on the blockchain. These properties of blockchains have substantial potential in banking. It can streamline processes by automating verification and settlement, reduce the need for manual reconciliation and paperwork, and minimize errors through tamper-proof recordkeeping. In doing so, blockchain could enable banks to deliver faster, more efficient, and more transparent services—helping them maintain their critical role in the economy while adapting to the demands of a digital era.

There are many ways banks can leverage blockchains; these innovations can be classified into 3 main, although sometimes overlapping, categories:

1. Efficiency-focused improvements using blockchain: A good example of this is Trade Finance. The paperwork and lengthy processes involved in settling transactions between banks and trade entities can be digitized and tracked step-by-step on a blockchain, thereby speeding up the process and enabling businesses to expand their reach into international markets swiftly. Blockchains, being a Digital Ledger, can be used to store these transactions and processes digitally. Its transparent nature allows for complete visibility for parties involved, whereas its secure and immutable nature establishes trust in the process1. Recently, HSBC has successfully been able to reduce the processing time for such transactions from 5-10 days to less than 24 hours using blockchain technology2.

2. Adoption of existing services on blockchain: Cross-border payments represent a significant opportunity for blockchain to make an impact. By leveraging its decentralized nature, a blockchain-powered payment system can reduce unnecessary intermediaries, allowing for secure and fast transactions. A Distributed Ledger Technology (DLT) with transactions using a digital cryptocurrency instead of traditional currencies can help speed up the process. In use cases such as cross-border payments, cryptocurrencies (or digital currency, both are used interchangeably in this article) are used as a proxy to transfer the funds between banks and intermediaries, and their digital and transparent nature ensures trust and efficient processing.

3. New Products based on blockchain technologies: Banks have attempted to launch new products using blockchain, including digital currencies and digital bonds, to explore the technology and find more effective, quicker methods for performing traditional functions. These products are, more often than not, stablecoins that are used as a proxy to real currencies (such as the US Dollar). Stablecoins are digital currencies that are pegged to an actual currency and used as a faster and secure alternative to real currencies. Some examples are JPM Coin, which is pegged to the US Dollar and used as a digital currency to facilitate interbank payments. They enable real-time, programmable transactions - by acting as a proxy for traditional currencies - while bypassing the legacy systems that traditional currencies need to go through to finish settlement.

Harnessing the power of Blockchains in banking not only helps organizations improve processes, but as a direct result, improves the banking experience and quality of life for its retail consumers like us. Faster processing, less human intervention and secure transactions have the potential to make banking hassle-free, cheaper and quicker3. Improved accountability, transparency, enhanced security and reduced frauds - the other benefits of blockchain driven solutions - can potentially impact the broader trust and access to banking and financial services for the underserved section of the society.

It is critical to note that most of the supposed benefits - like faster payments, lower fees, and greater transparency - remain largely theoretical at this stage. In principle, blockchain could streamline transactions by cutting out intermediaries, potentially reducing costs and processing times. The promise of improved transparency, since transactions on a distributed ledger are visible and auditable by design. This, arguable, could enhance trust and security, making it harder for bad actors to manipulate records.

However, these improvements are far from guaranteed at this stage. The actual consumer experience depends on how banks and payment providers implement blockchain, and whether they pass any savings or efficiencies on to end users. That said, there are clear upsides to unlocking these benefits - if even a fraction of these promised improvements materialize, the way we interact with financial services could look very different - and for the better.

The aforementioned possible innovations present a strong case for investing in this technology to potentially reimagine the industry. So we arrive at the central question: why are banks not treading this path? Why has the blockchain revolution not exploded in banking? What prevents them from fully adopting blockchain?

To their credit, many banks have recognized the potential of blockchain and have implemented, to varying degrees of success, some prominent innovations in this area. While some of these have enjoyed a fair bit of success, most of these innovations fall short of reaching mainstream implementation.

In the following sections, we deep dive into three major challenges a blockchain innovation faces in a banking context. Using real-life case studies, highlighting key concerns, winners and losers, we will explore and understand the future implications and potential solutions in overcoming these issues.

Financial governing bodies worldwide are striving to understand cryptocurrency and the DeFi ecosystem. There is still significant confusion surrounding these new "currencies" because they function fundamentally differently from traditional money, which has been around for hundreds of years, with the international system of payments almost 100 years old now. Consequently, the regulatory guidelines on digital currencies and related assets - should they be classified as securities, commodities, or something entirely new? - remain unclear4. As a result, the rules for regulating the exchange of digital currencies and their interactions with the broader financial environment are still unresolved, particularly when it comes to who is responsible for safeguarding digital assets, and how these assets should be valued, reported, and taxed on financial statements.

In the banking world, several activities involve transactions with other banks and institutions - these could be either to transfer currencies from one account to another, short-term borrowing/lending or forex transfers. Because these currencies reside in the databases running within each of these institutions, communication between these "islands of data" requires convoluted and ineffective reconciliations and settlement processes. As a result, several initiatives have been undertaken to use digital currencies (specifically, stablecoins) to quicken inter-bank transactions. DLTs like blockchain have a direct application here. Unfortunately, the regulatory standards, frameworks and guidelines regarding stablecoins are nebulous at best. Regulatory agencies, for consumer protection and institutional risk related reasons, have been actively trying to install guardrails around stablecoins; a proposed stablecoin regulation by the Biden administration was introduced to allow only federally insured depository institutions to issue them, essentially preventing them from being used in several critical use-cases5. While regulations like these have the potential to make stablecoins tightly regulated and safer for integration with existing banking functions - making their adoption easier at first - but the high regulatory bar makes it almost impossible for outside players to invest and drive innovation in this sector. This has a broader impact on the cryptocurrency market - as transferring traditional money to cryptocurrencies is generally carried out by using stablecoins like Tether. On the banking side, this unlocks certain barriers, while installing certain others. A clear balanced regulatory approach is still needed to make stablecoins adoption and usage more safer, secure and inclusive for institutions and innovators alike.

Furthermore, usually, banks leverage blockchains and networks of established digital currency technology partners to power their use cases. This exposes them to the regulatory risks concerning these partners. Santander, a Spanish multinational financial services company, famously launched their cross-border payments systems in association with Ripple, a leading blockchain solutions firm, leveraging their blockchain network and expertise in this area. This not only requires Santander to navigate the cross-border compliance policies, anti-money laundering (AML) requirements and Know-Your-Customer (KYC) policies, but also exposes it to the various regulatory challenges faced by Ripple itself, particularly related to the cryptocurrency powered by its blockchain - XRP. XRP is at the heart of Ripple’s ecosystem, which acts as a substitute to local currencies to facilitate cross-border transactions. This behavior, even though it provides much faster and efficient transaction settlement than traditional methods, has drawn regulatory scrutiny, especially in the United States - where concern over whether to classify it as a security has led to lengthy legal battles. When partnering with organisations such as Ripple, Santander exposes itself to such legal and regulatory risks that come with digital assets like XRP. This highlights the importance of firm regulatory guidelines regarding cryptocurrencies - these will not only help banks issue them in a more secure manner, but also help them partner with other organisations with more reliance and trust.

Banks and legislative bodies have come together in recent years to clear the regulatory air around digital assets and provide a platform for institutions to leverage them in a way that balances innovation with compliance.

One of the biggest advancements in this area is the concept of Regulatory Sandboxes. These frameworks enable businesses to test innovative products, services, or business models in real-world settings while under the supervision of regulators. Operating with temporary regulatory relief, these environments allow companies to explore new technologies with minimized legal risks. This approach serves a dual purpose: it provides businesses with a platform for rapid innovation and allows regulators to anticipate new policies and challenges by observing emerging technologies in action. The EU and the UK are at the forefront of this initiative, having launched industry-focused sandboxes like the UK's Digital Securities Sandbox and the EU's DLT program to guide financial innovations6.

In certain cases, banks have invested in creating custom blockchain networks specifically to facilitate financial transactions. These 'consortium' blockchains, which are collaborative platforms managed by a group of organizations, are designed to effectively balance control, access, and scalability concerns, making them a preferable solution to traditional public blockchains. Banks need to focus on balancing appropriate levels of access, consensus mechanisms, and security protections while assessing the costs and benefits of implementing blockchain technology. By adopting these consortium blockchains, banks can proactively navigate regulatory challenges while also leveraging the benefits of a trusted technological framework. Examples of these consortium blockchains, such as the R3 Corda platform and JP Morgan's Quorum, highlight their successful utilization by financial institutions worldwide, showcasing the potential of blockchain technology within the banking sector.

A 2024 Forbes survey revealed that 55% of banks cite legacy systems as a key obstacle to digital transformation7. These systems, often based on outdated programming languages like COBOL, struggle to support real-time payments, AI-driven analytics and automated compliance checks.

As financial organizations face increasing pressure to modernize and innovate, their over-reliance on legacy systems and cultural resistance to digital transformation present significant hurdles. These challenges not only affect the implementation of blockchain solutions but also hinder the adoption of less technologically intensive innovations like real-time advanced analytics.

Another key aspect at play is talent. Blockchain expertise is scarce, and the industry requires specialized knowledge to implement innovations at scale. Given the numerous regulatory, security, and operational risks, banks must invest significantly in hiring and training qualified personnel.

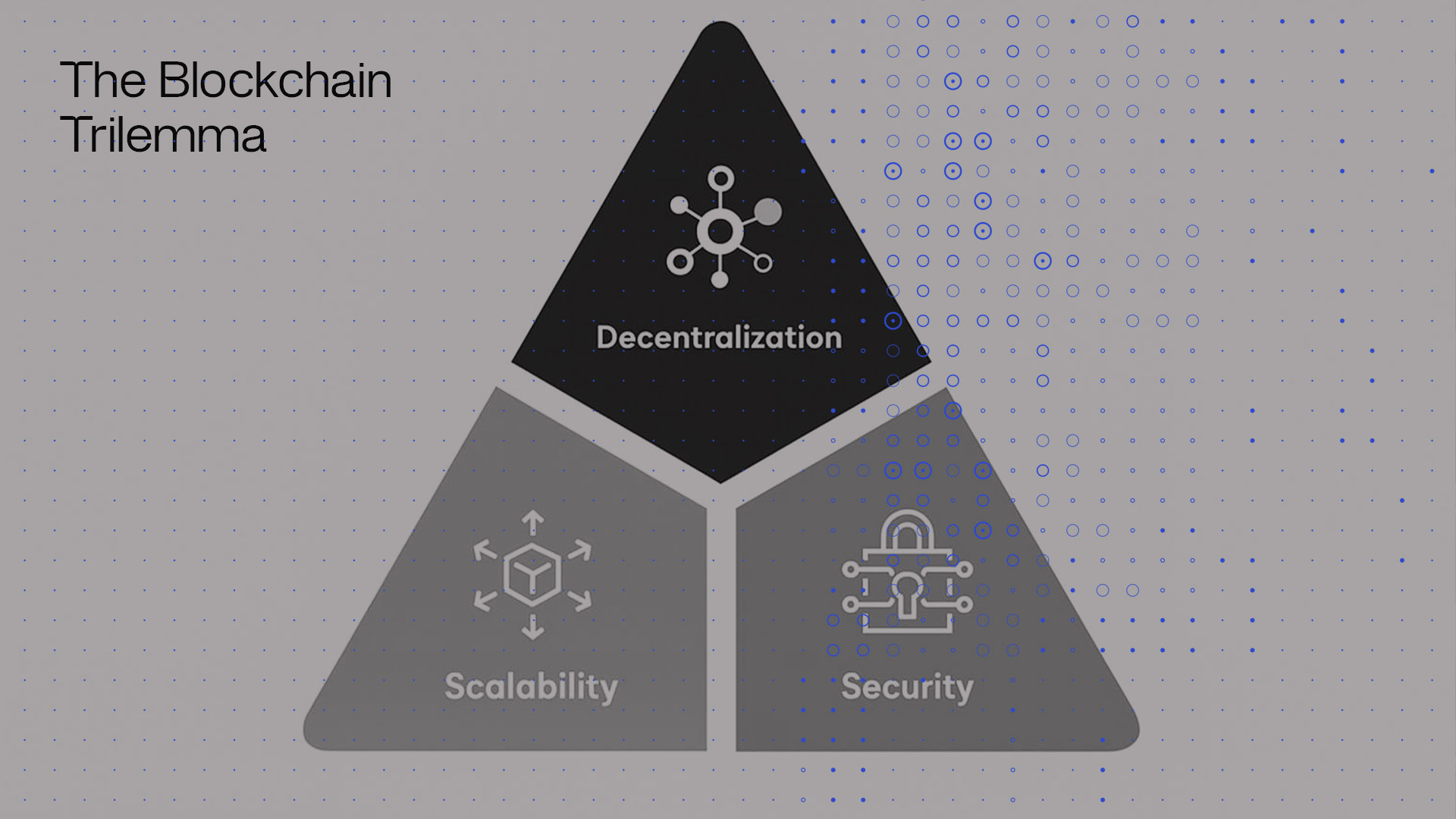

A significant technical hurdle for blockchain technology is its inherent scalability concerns, which refer to the ability of a blockchain to process transactions at a faster rate. By design, more secure blockchains tend to be less scalable—a concept illustrated by the "Blockchain Trilemma," which highlights the necessary trade-off between scalability, decentralization, and security8. Consequently, a blockchain cannot achieve all three simultaneously. While blockchains provide decentralized trust and security, they encounter notable challenges in scaling their operations, an issue that is intrinsic to the technology itself rather than limited to the banking sector.

Scalability limitations are a critical obstacle to the widespread adoption and utility of DLTs. Without addressing these challenges, blockchains risk being relegated to niche use cases rather than serving as the backbone for broader banking applications like digital identity or supply chain tracking. To truly enable mass adoption, blockchain developers need to find innovative solutions to overcome scalability hurdles9.

What is often overlooked in this debate is that the trilemma isn’t just a technical puzzle - it is a cost problem too. The more a blockchain leans into security and decentralization, the more expensive it becomes to scale. High security means more computational resources, more validators, and more energy consumption, all of which drive up the cost. Attempts to boost scalability can reduce costs, but often at the expense of either decentralization or security. For banks, this means that even if the technology matures, the economics may still be prohibited for anything beyond niche applications.

Data privacy concerns are a frequently discussed issue with blockchains. Transparency, a key tenet of DLTs, directly conflicts with strict data privacy regulations in the banking sector, such as GDPR, which mandates rigorous control over the storage, access, and sharing of data. Each transaction on the blockchain requires validation - or, in blockchain terminology, reaching a consensus - by its members, who, ideally, possess all necessary information for validation. This requirement risks violating data privacy standards.

The core issue is twofold. First, there is a need for technological solutions that enhance the opacity of blockchain transactions while maintaining a secure consensus mechanism. Second, regulatory adjustments are necessary to redesign privacy standards with DLTs in mind. Various solutions have been developed to tackle the first challenge, collectively referred to as Hybrid Blockchains. These combine public and private blockchains - the difference being in the ownership and access to the network. A public blockchain is fully transparent, where anybody can join, read, write and validate transactions on the chain, such as Bitcoin. A private blockchain, on the other hand, is controlled by a single organization or a group of trusted entities. Only approved participants can access, validate, or add data to the network. Private blockchains are often used by businesses or banks for internal processes, offering more control and privacy but less decentralization than public blockchains. A combination of public and private networks, hence, allows organizations to retain sensitive information on a private chain while keeping only the essential data for validation on the public chain. While this approach adds complexity and raises interoperability concerns, it strikes a balance between transparency and privacy. Ultimately, hybrid blockchains hold significant potential for the banking sector - by designing a more centralized infrastructure, they enable scale and security, as established by the blockchain trilemma. They provide a reasonable solution for cost as well, as sacrificing decentralization for security reduces the need for more cost-intensive solutions that rely on changing the deeper functioning of blockchains10.

JPMC's Quorum is a successful implementation of a large-scale Blockchain Initiative. This permissioned blockchain protocol, based on Ethereum, offers features such as transaction privacy, the ability to execute private transactions and smart contracts, support for multiple consensus mechanisms, and flexible network permissions management. Essentially, Quorum is a modified blockchain developed specifically for financial institutions and their unique use cases.

Like other innovative technologies, Quorum has faced technical challenges, including data privacy, scalability, and standardization. A lack of knowledge about blockchain technology has hindered adoption and the creation of a global regulatory framework. Security breaches pose a constant threat, largely due to human errors related to this knowledge gap rather than flaws in the core technology.

However, through continuous efforts, investments, and visionary leadership from the Quorum team, this system has been successfully implemented, providing banks with a secure platform to launch their proprietary blockchain projects. Addressing these technological barriers requires ongoing investment and time for blockchains to become commonplace in the banking sector.

Traditional banking processes are slow due to multiple intermediaries involved in inefficient information exchanges. This challenge is especially pronounced in specific use cases like Trade Finance, where extensive documentation and a lack of streamlined Customer Due Diligence lead to delays.

Blockchain technology offers a promising solution for these issues. "Smart Contracts" - digital contracts that are written in code - are engineered to facilitate, execute, and enforce agreements using blockchain, helping to reduce information asymmetries between parties. The involved parties can use the transparent architecture of blockchains to view real-time updates of the concerned trade. Moreover, this technology can streamline payments and regulatory processes across use cases, marking one of the most significant improvements that blockchain can bring to banking11. For example, they can be used to automatically release payments once the goods are confirmed as delivered on the blockchain, reducing the need for manual intervention - streamlining the process and reducing the risk of disputes.

In 2019, HSBC launched Serai, a trade finance solution based on a distributed ledger platform designed to connect suppliers with buyers and digitize transactions. Another significant initiative, we.trade, was owned by European banks and powered by IBM. However, both of these efforts were eventually shut down due to commercial infeasibility.

The main challenge was adoption. Without all parties involved in a transaction using the blockchain, the additional benefits of the technology diminish. This scenario is reminiscent of the inefficient Nash Equilibrium in game theory; there is little incentive to become an early adopter. This phenomenon contrasts with the typical adoption pattern of disruptive technologies, where early adopters lead the industry, attracting more users until a critical mass is achieved that makes the innovation commercially viable. The lack of interoperability among blockchains further limits the scalability of these initiatives12.

In our smart contract use case, if one party lacks direct access to the blockchain containing the contract, they must rely on facilitators, such as banks, to provide alternative means of access. This process involves bringing information down from the blockchain, which not only decreases efficiency but also introduces security concerns. Consequently, this deters all parties from continuing to use the solution, as the inefficiencies it was meant to address persist. This leads to decreased usage, abandoned solutions, and disheartened early adopters, reducing the incentive for future innovations.

Many applications restricted within a banking ecosystem can effectively bypass these issues, as demonstrated by Wells Fargo’s internal settlement blockchain solution. Wells Fargo Digital Cash enables the bank to settle internal transactions between its overseas branches without relying on traditional methods like wires or SWIFT. This solution not only accelerates settlement speed but also eliminates transaction fees typically charged by payment facilitators. SWIFT and Wire transfers typically charge 1-5% of transfer amount, along with some flat fees. These fees are attributed to multiple intermediaries, in case of SWIFT, or to higher manual intervention, in case of wires. Due to the same reasons, they take anything from 1 day to a week to settle. Blockchain solutions are dramatically cheaper and near-instant - particularly because of reduced need for intermediaries and manual input, some studies quote a reduction of cross-border payment costs for banks by up to $10 billion globally in 203013.

“When we move money across the world and we need to exchange currencies, we have to go through third parties such as SWIFT and other banks,” explained Lisa Frazier, head of the Innovation Group at Wells Fargo. “That’s a long process, and every time there's a connection with external parties, it takes time and energy and effort.” Wells Fargo utilizes R3's Corda enterprise blockchain for these digital transactions. Since there are no external participants involved, they encounter significantly fewer interoperability issues and maintain greater control over the transactions. Additionally, using a popular and stable consortium blockchain helps them navigate many regulatory and technical challenges.

Wells Fargo plans to move beyond internal transactions and introduce an FX cross-border solution similar to Santander, but scalability issues related to interoperability remain a challenge. They are currently collaborating with HSBC, another leader in the banking industry, pioneering blockchain solutions, to settle matched cross-border transfers for a set of currencies. A holistic solution, potentially completely revolutionizing international payments settlements, is far away in the future, if at all.

In conclusion, while blockchain technology holds revolutionary potential for the banking sector, significant challenges persist in its deployment and scaling within the current landscape. Lawmakers and financial institutions must undertake major efforts to pave the way for the full realization of this technology's benefits.

Regulatory bodies need to come together to lay the foundation of a necessary legal framework to govern decentralized finance and cryptocurrencies. Only then will the banks be able to move forward with enough confidence and invest the requisite capital to drive innovation in the sector. These bodies must address jurisdiction, recognition and privacy issues related to DLT technologies. The solutions should first be rolled out at national or regional levels and eventually spread worldwide.

Lawmakers worldwide should look towards legislative bodies which have been successful in providing a favorable regulatory environment for innovative blockchain implementations. Countries like Japan, Singapore, the EU, and Switzerland foster innovation through favorable regulations that recognize cryptocurrencies, guide AML and KYC compliance, and stimulate a vibrant startup ecosystem. Even if the regulations are strict, especially considering data-privacy issues, the regulatory landscape is explicit enough to guide developers and institutions to drive blockchain-led projects. Countries like China, despite banning the trading of cryptocurrencies, provide regulatory guidelines for exploring enterprise-level blockchain innovations14. The heavy focus on data privacy and security issues requires developers and institutions to be especially wary of these challenges while driving innovations.

One of the biggest challenges to digital transformation in banking is the deeply embedded legacy systems, which are not only difficult to upgrade but also pose security risks. However, the emergence of AI offers promise, as it can help banks develop strategies to overcome these challenges and create a "do-or-die" scenario for modernization. With the enormous popularity of AI, banks are expected not only to integrate it throughout their workflow but also to leverage its capabilities to ensure compliance with regulatory standards. This will lead the way for capabilities that can drive blockchain innovations in tandem, enhancing efficiency and security across transactions.

Many banks are exploring use-cases that leverage a combination of AI and blockchain technologies, such as using blockchain to record identities alongside employing AI to enhance fraud compliance15. Blockchain could be significantly impacted by advancements in AI, though the actual integration may vary across the banking sector. Even in best-case scenarios, there are concerns about how long it will take for banks to be ready and whether a lack of investment in this technology will arise due to delays and technical transformations these projects demand.

Organizational challenges persist as deeply embedded legacy systems complicate upgrades and create security risks for banks. Although some banks have successfully integrated blockchains for internal processes, the real value lies in their ability to reduce paperwork and improve transparency in areas like trade finance and cross-border payments. Interoperability is crucial for banking institutions, and insufficient early adopters will hinder the widespread adoption of blockchains. There is a critical need for ‘Blockchain Interoperability’ in the banking sector due to the ability of various blockchain networks to communicate effectively, which is largely hindered by fragmented regulations worldwide.

Blockchain interoperability refers to the capability of various blockchain networks to exchange information and utilize each other's functionalities. It enables seamless data and asset transfers across various blockchain platforms, improving transaction efficiency and security while eliminating intermediaries. Current projects focused on cross-chain communication protocols aim to connect different blockchain networks, empowering banks to share data even without a common network. In the smart contract use case, atomic swaps utilize cryptographic techniques to facilitate the transfer between parties across different networks. Developing interoperability platforms, which allow for cross-chain protocols and atomic swaps, will significantly facilitate the widespread adoption of blockchains despite the current fragmented regulatory landscapes. Certain recent projects, such as Polkadot and Cosmos, are already trying to enable this blockchain interoperability to facilitate inter-chain transfers.

Finally, it is important to note the interconnectedness of these barriers - these challenges reinforce one another, and addressing any single one can alleviate related challenges, leading towards comprehensive solutions. This is where the ultimate solution lies.

Interoperability, for example, is largely dependent on the fragmented regulations across the world. If the regulatory bodies align on standardized blockchain guidelines, banking institutions across the world would be able to develop solutions with similar security and privacy features. These standardized blockchain networks that comply with stated regulations are necessary for effective growth and operation across various financial institutions. Adhering to aligned regulations, these would be easier to integrate, driving cross-platform connections and lowering security risks.

In a similar vein, a global digital upgrade of legacy banking systems aims to facilitate blockchain solutions, helping ensure compliance with regulations. This modernization will enhance the interoperability of these platforms, significantly boosting user adoption across various markets. A standardized regulatory landscape allows cohesive technological frameworks, facilitating interoperability that encourages widespread adoption.

Standardized regulations, technology, and operational processes are critical for widespread adoption and the gradual reimagining of the banking landscape. Evidence supporting standardized regulations can be found in the European Union, demonstrating a commitment to effective blockchain governance. The EU serves as a pivotal testing ground for standardized regulations on blockchain implementations across varied nations. These examples demonstrate that overcoming barriers significantly enhances banking experiences and paves the way for future innovations in blockchain technology.

In conclusion, as the banking industry stands at the crossroads of tradition and innovation, the potential of blockchain technology to revolutionize financial systems cannot be overstated. While challenges such as regulatory hesitance, operational inefficiencies, and technological barriers remain significant, the benefits of adopting standardized practices and collaborative frameworks are clear. By addressing these issues through organizational change, investment in technology, and global compliance standards, banks can navigate the complexities of this transformation. As we move forward, embracing blockchain not only promises to enhance operational efficiency but also to create a more secure, transparent, and efficient banking landscape, ultimately fostering a brighter future for the global economy.

[1] Appinventiv. (2024). How is Blockchain in Banking Transforming the Industry? Retrieved from https://appinventiv.com/blog/blockchain-in-banking/

[2] HSBC UAE. (2023). Blockchain – Transforming the future of trade finance. Retrieved from https://www.hsbc.ae/business-banking/insights/blockchain-trade-finance/

[3] Investopedia. (2023). Blockchain Facts: What Is It, How It Works, and How It Can Be Used. Retrieved from https://www.investopedia.com/terms/b/blockchain.asp

[4] Cato Institute. (2023). Opening the Door to Cryptocurrency Innovation by Eliminating Unnecessary Regulatory Barriers. Retrieved from https://www.cato.org/commentary/opening-door-cryptocurrency-innovation

[5] Selgin, G. (2023). A Simple Proposal for Regulating Stablecoins. Cato Institute. Retrieved from https://www.cato.org/commentary/simple-proposal-regulating-stablecoins

[6] Deloitte. (2023). How Regulatory Sandboxes Foster Innovation and Compliance in Crypto. Retrieved from https://www2.deloitte.com/global/en/pages/financial-services/articles/regulatory-sandboxes-crypto.html

[7] Forbes. (2024). Core Banking Crisis: 55% of Banks cite Legacy Systems as the top barrier to transformation. Retrieved from https://www.forbes.com/sites/forbestechcouncil/2024/01/15/core-banking-crisis/

[8], [10] Hedera. (2023). Blockchain Scalability Solutions. Retrieved from https://hedera.com/learning/what-is-blockchain-scalability

[9] Banerjee, T. (2022). Blockchain Implementation Challenges for IoT. In Blockchain (pp. 73-85). Chapman and Hall/CRC

[11] ConsenSys. (2023). The Ultimate Guide to Understanding Smart Contracts. Retrieved from https://consensys.net/knowledge-base/smart-contracts/

[12] IBM. (2023). Blockchain Interoperability: Future of Seamless Integration. Retrieved from https://www.ibm.com/topics/blockchain-interoperability

[13] Juniper Research. (2023). Blockchain to Facilitate Savings of $10 Billion Globally in Cross-border Payments. Retrieved from https://www.juniperresearch.com/press/press-releases/blockchain-savings-cross-border-payments

[14] Cointelegraph. (2023). Revealing Blockchain Regulations By Country: Insights & Challenges. Retrieved from https://cointelegraph.com/news/blockchain-regulations-by-country

[15] Forbes. (2024). GenAI: 15 Practical, Impactful Applications For Startups. Retrieved from https://www.forbes.com/sites/forbestechcouncil/2024/02/10/genai-15-practical-applications/